Smart Money: The Personal Finance Plan to Crush Debt

The book Smart Money: The Step-by-Step Personal Finance Plan to Crush Debt will be available on March 16, 2021. Click the link below to get your copy.

As seen in

Straightforward steps to financial freedom and wealth

Getting a handle on personal finance can be confusing and stressful. Get unstuck and start saving now with this streamlined, holistic plan for financial wellness. Smart Money makes it simple to ditch debt and jump-start your wealth in nine practical steps. Learn how to avoid money pitfalls, correct any wrong turns, and save and spend the right way to build wealth.

Naseema Shows You How to Get Started

Start by assessing your current personal finance, figuring out how much you owe, and comparing your income with your spending. With a wealth of budgeting wisdom, saving strategies, banking tips, and advice for investing, you’ll find out exactly how to set realistic goals―and watch yourself breeze through them.

What’s Inside?

A step-by-step plan

Build a strong foundation with a plan that includes putting your money in the right bank, making your credit card work for you, and prepping for big-ticket expenses.

Simple, helpful tools

Implement changes at each stage of financial planning with the help of handy budget worksheets and checklists.

Tips and tricks

Master the tools of wealth-building with tips including seven ways to tackle debt, five credit card commandments, and more.

Meet the Author

I’m Naseema McElroy, and I’ve paid off $1 million dollars in debt.

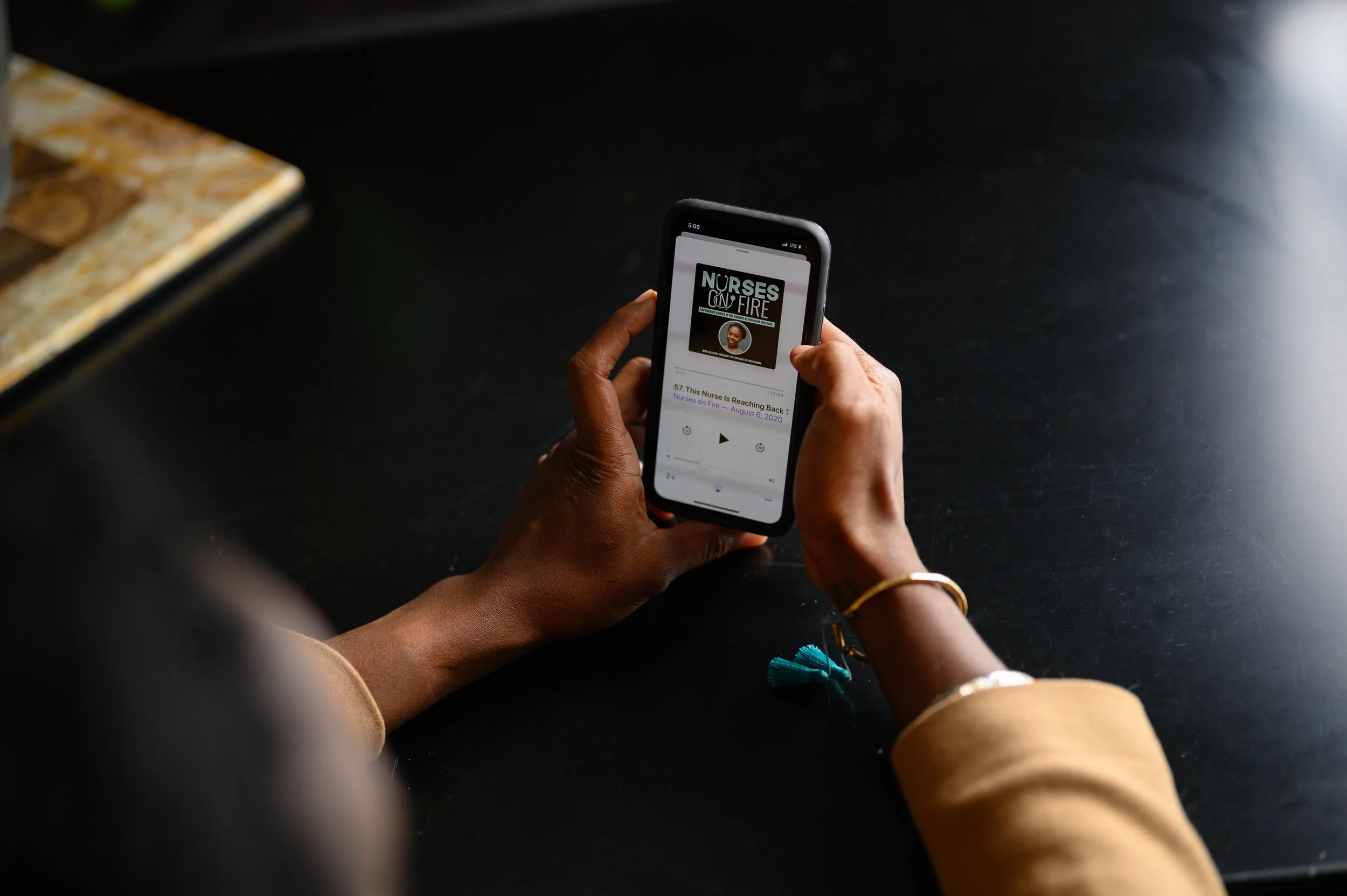

I am the founder of Financially Intentional, a platform about personal finance and living life intentionally. I am also the host of the Nurses on Fire Podcast, where I introduce nurses to the world of financial independence. I discuss how taking control of my finances has enabled me to overcome bankruptcy, divorce, and break the cycle of living paycheck to paycheck. I share my lessons along my path to help others benefit from the freedoms of financial independence.

Outside of encouraging people to get their financial act together, I am a mother of two girls and Labor and Delivery Nurse. Though making six figures for years, I struggled with money. Finally realizing I couldn't out-earn my financial ignorance, sI knew I had to make some changes. By shifting my mindset around money, being consistent and intentional, I paid off $1 million in debt and grew a six figure net worth in three years, without living in deprivation.

Jumpstart your financial health and wealth.

Order your copy of the book today to get your hands on a streamlined 9-step plan for financial wellness. The book make it simple to start revitalizing your finances. And you’ll learn how you can ditch debt, tackle your money goals, right any wrongs turns, and build financial wealth.

You belong here.

Join our free online community of debt-slayers

and get access to exclusive resources that will take you from living paycheck to paycheck to having stacks in the bank.